The Sustainable Indigenous Finance Initiative

A collaboration between First Peoples Worldwide and US SIF launched the Sustainable Indigenous Finance Initiative (SIFI) at the SIF FORUM 2025 held in June in Washington, DC to standing room only crowds for both Indigenous Peoples sessions. The SIFI inaugural panel was opened by former Secretary of Interior Deb Haaland followed with a powerful plenary moderated by Mark Trahant Founding Editor ICT, Wharton Professor Witold Henisz, First Nations Major Projects CEO Mark Podlasly, and Kyle Whyte Director of the Tishman Environmental Science Center.

The Breakfast Roundtable provided an advanced preview of the Sustainable Indigenous Finance: Investors Guidebook, Navigating the Energy Transition where it was proclaimed a “tour de force” for investors. Designed to be a working resource for investors The Guidebook includes tools, case studies and checklists to help investors accurately identify, assess and mitigate the risks related to Indigenous concerns particularly in the context of energy transition and land-based sectors.

The earliest collaboration between First Peoples Worldwide (FPW) and US SIF was in 1994 at a time when Indigenous Peoples were seen as part of the environment not as sovereign, culturally distinct, landowners and rights holders. FPW founder and Calvert Social Investment Funds Trustee Rebecca Adamson created the earliest standalone Indigenous Peoples Investment Screen. Collaborating with US SIF members, Indigenous Peoples Rights became one of the top 3 shareholder concerns for the next two decades. In 2004, the Onieda Nation, through the leadership of Susan White, collaborated with US SIF and incubated the Investors and Indigenous Peoples Working Group IIPWG. In 2017, FPW was Advisor to the Standing Rock Sioux Tribe on their DAPL investor engagement efforts joining again with US SIF in a worldwide campaign to reroute the Dakota Access Pipeline DAPL.

Today the SIFI collaboration combines the financial acumen, academic rigor and Indigenous thought leadership to flip the script on business models that presume you can do it faster and cheaper without sociopolitical-community risk mitigation. As the world transitions to a low-carbon economy, the material relevance of Indigenous voices has never been clearer. From mineral extraction to renewable infrastructure development, many projects intersect directly with Indigenous lands and communities. Indigenous inclusion is no longer a matter of ethics or compliance – it is fundamental for managing financial risks and opportunities.

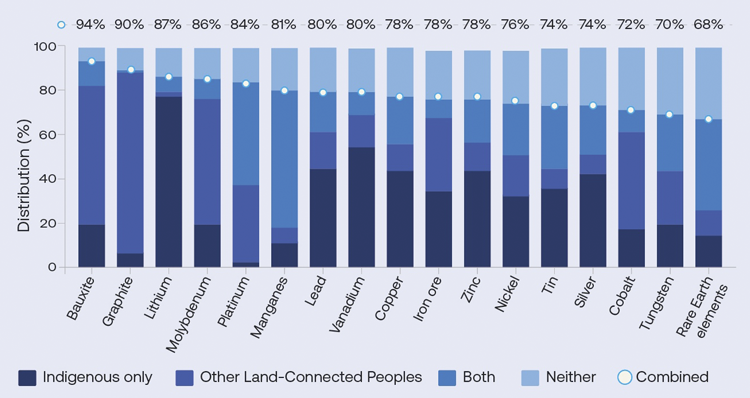

Geographic distribution of 5,097 mining projects for energy transition minerals and metals, highlighting overlap with Indigenous Peoples’ land and other land-connected peoples.²

Globally, 72% of investors believe that energy transition investments are accelerating, despite geopolitical uncertainty and fluctuating interest rates. Yet companies often overlook or disregard the impact of their actions on Indigenous Peoples, leading to conflict and violence that, in turn, creates significant business risks – including supply chain disruptions and legal disputes – that can diminish future growth and undermine long term portfolio performance. Indigenous Peoples’ lands hold over half of the deposits for thirty of the essential minerals and metals that are necessary to the energy transition, including 85% of the lithium and 75% of the manganese. Fifty-four percent of the 5,097 global transition mineral and mining projects are located on Indigenous territories.

SIFI comes at a time when the global economy is undergoing a rapid and urgent transition to low carbon technologies and sustainable practices. This shift is driving a surge in capital flows to finance the investments required for this transformation. In 2024, annual investment in the energy transition passed $2 trillion.¹ However this transition is unfolding on complex terrain. Until recently investors lacked access to the data and tools that tied a company’s capacity to manage risk with its performance costs and revenue shortfalls.

Distribution of reserves and resources for 17 key minerals and metals, which account for the highest number of extractive projects globally. Percentages at the top of the graph reflect the combined total for Indigenous and peasant land overlap.²

A groundbreaking study by the Wharton School introduced the first quantitative processing approach to determine how foreign direct investments impacts Indigenous Peoples. Using artificial intelligence to track over 2,300 business and conflict themes the study found that projects located within 31 miles of Indigenous territories experience on average 10 more conflict events per year than otherwise similar projects. For projects within 10 km (6.2 miles) of an Indigenous land claim, the annual incidence of material events, such as costly disruptions, increases by as much as 500%.

According to the International Energy Agency, achieving net-zero globally by 2050 will require six times more mineral inputs in 2040 than we use today. The confluence of the new energy transition and the growing demand for natural resources is placing acute pressure on Indigenous Peoples. The purpose of SIFI is to elevate Indigenous decision-making and to offer meaningful engagement with Indigenous thought leadership, cutting-edge tools and datasets, practical resources and a dynamic SIFI Resource Hub. The SIFI Resource Hub when fully launched will provide a platform to share best practice, offer analytical tools and access to the latest evidence-based research that links a company’s negative impact on Indigenous Peoples to its financial performance. The Hub is an interactive collaborative platform for investors, academics, NGOs and Indigenous members to elevate indigenous innovation, host webinars, curated campaign dialogues, panels, conflict mapping, and latest research topics.

The Sustainable Indigenous Finance: Investor Guide, Navigating the Energy Transition will be released this Fall. The coauthors, First Peoples Worldwide and ImpactARC, an independent women-owned sustainable advisory firm, conducted over 25 interviews across the investment landscape with sustainable investment professionals, institutional asset managers, Indigenous leaders, rating agencies, academics, NGOs, data providers, and legal experts who all expressed the lack of a business case. They needed tools to translate Indigenous priorities and concerns into the investment language with an emphasis on risk management, financial materiality and long-term investment performance.

This new Investor Guide is designed primarily for investors, investment advisors and investment managers who make investment decisions for their clients including trustees who may oversee the management of assets. To inform this guide, we conducted extensive research – drawing on academic reports, case studies, existing frameworks and tools, legal cases, and corporate findings. The Guide outlines why and how investors should consider Indigenous Peoples in their investment decision-making including 18 case studies of what worked and what didn’t. It offers a three-tier de-risking framework. The institutional level and the importance of good policies, oversight and institutional capacity. The portfolio level where initial screening can identify companies in high-risk geographies or high-risk sectors that may require additional due diligence. And the project level where the system wide capacity of a company to manage risk undergoes due diligence to assess whether the company has the competence and managerial capacity to address its operational risks, legal risks, reputational risks, and or even broader systemic instability related to negatively impacting Indigenous Peoples.

Regardless of rapid permitting and deregulating efforts, the more effort a company puts upfront to get it right the more money the company is going to save in the long run. SIFI aims to turn risk into opportunity. Given Indigenous Peoples steward 50% of the world’s land, 54% of the remaining intact forests, and encompasses 40% of key biodiversity areas essential to the survival of unique species, critical water sheds and vast mineral reserves.

In closing, let me quote, Fawn Sharp, the 23rd President of the National Congress of American Indians, who spoke at the Breakfast roundtable on the SIFI and stated, “integrating indigenous knowledge and stewardship into your investments not only aligns with responsible investment standards but also unlocks long-term value creation.”

Article by Rebecca L. Adamson, President and Founder of First Peoples Worldwide. Rebecca is an internationally recognized Cherokee Economist, who started with the Coalition of Indian Controlled Schools (1972) which led to the 1975 Act for Indian Self-Determination and Education Assistance and today is eponymous Wharton School Rebecca Adamson Indigenous Peoples Risk Index. In 1980 Adamson established the First Nations Development Institute, created the first microloan fund, the Lakota Fund, on Pine Ridge Reservation SD 1984, created the First Nations’ Oweesta Fund a CDFI intermediary and Community Development Financial Institutions (CDFI) Act of 1994.

In 1989 Adamson joined the Calvert Social Investment Funds Board, led the creation of High Social Impact Investing HSII 1991 and established a public private partnership with Calvert Foundation that became Community Notes (1996). She created the first Indigenous Peoples Investment Screen 1993, led numerous Indigenous shareholder campaigns, and helped establish the Investors and Indigenous Peoples Working Group (IIPWG).

In 2004, Adamson founded First Peoples Worldwide, created the FPW Shareholder Advocacy Leadership Training (SALT) 2012, and first effort to quantify investment risk, The FPW Indigenous Peoples Rights Risk Report (IPR3) 2014. She was advisor to the Standing Rock Sioux Nation Council on the Energy Transfer Dakota Access Pipeline DAPL shareholder advocacy campaign 2017-2018. Adamson launched the 30X30 international Indigenous Peoples’ campaign 2019 that established general fiduciary and financial accountability standards “Core Human rights Principles for Private Conservation Organizations and Funders” 2025. She is Advisor to Calvert Impact Capital, Climate United Advisor, and Wharton 2022-2025 on cultural metrics and Wharton ESG WEIP Team teacher: WEIP Study: Long Term Thinking and Indigenous Peoples Financialization of Nature. May 2025.

Footnotes: